On Feb. 7, Encompass Health released its fourth quarter earnings report and provided initial 2023 guidance. Below are a few key takeaways from the report to help you gain a better understanding of our performance in the fourth quarter, which provided a strong finish to another year of growth.

Strong Patient Volumes Fueled Continued Expansion

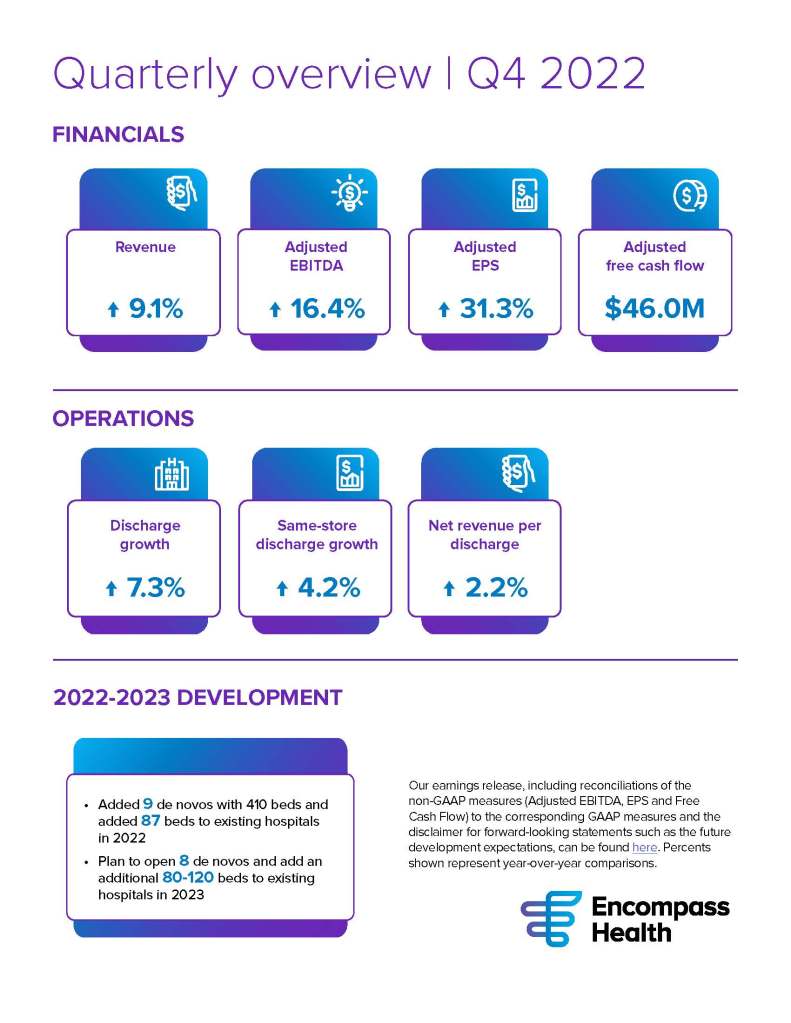

Demand for our services remained strong with a fourth quarter discharge growth of 7.3%, contributing to a full-year discharge growth of 6.8%. We continued to invest in capacity expansions, opening nine new hospitals in 2022—the most in a single year to date. We also added 87 beds to our existing hospitals, leading to a net 4.4% increase in licensed beds in 2022.

To contain costs and increase our speed to market, we increased our use of prefabrication—the assembly of building components at a location other than the building site—to design and construct new hospitals. Our use of prefabrication has progressed from headwalls, to bathrooms, to exterior walls and, in 2022, two-patient rooms connected by a corridor. This year, we’re planning to pilot full hospital prefabrication.

We Continued to Invest in Existing Hospitals and New Technologies

In 2022, we invested nearly $600 million in capital expenditures, including upgrades to many of our existing hospitals and construction of replacement hospitals. We also continued to invest in technologies to improve patient care, such as Tablo on-site dialysis. We now offer in-house dialysis in 41 of our hospitals and will continue to implement this technology in more of our hospitals in 2023. Reducing our reliance on third-party providers and avoiding patient transport to receive dialysis reduces costs and improves patient outcomes and satisfaction.

We Overcame Labor and Inflationary Challenges

Our labor management strategies and solid contributions from our new hospitals facilitated a year-over-year increase in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). This increase was achieved despite elevated labor costs and double-digit inflation in the second half of the year. The strength and consistency of our free cash flow generation allowed us to fund our growth and distribute nearly $100 million to shareholders with a limited need to borrow money.

We Provided our Initial 2023 Guidance

Our initial 2023 revenue guidance of $4.68 billion to $4.76 billion reflects our expectations of continued strong growth this year driven by both volume and pricing gains. Our initial 2023 guidance ranges for adjusted EBITDA ($860 million to $900 million) and adjusted earnings per share ($2.87 to $3.16) reflect solid growth while taking into account the continued uncertainty around labor costs and the impact of inflation.

Our People Remain the Foundation of our Success

None of this success could have been accomplished without our more than 30,000 dedicated employees. The past three years have been complicated with a lingering pandemic, tightening labor market, burgeoning inflation and the spin-off of Enhabit Home Health & Hospice. Our team has consistently risen to meet these challenges and seize opportunities. Our value proposition and operating strategy have been further validated, and we remain highly optimistic about the long-term prospects of our business.

For more information on our results for the fourth quarter, view our earnings release and supporting materials.

The content of this site is for informational purposes only and should not be taken as professional medical advice. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding any medical conditions or treatments.